Goals

Regain Our Customers’ Confidence, ASAP!

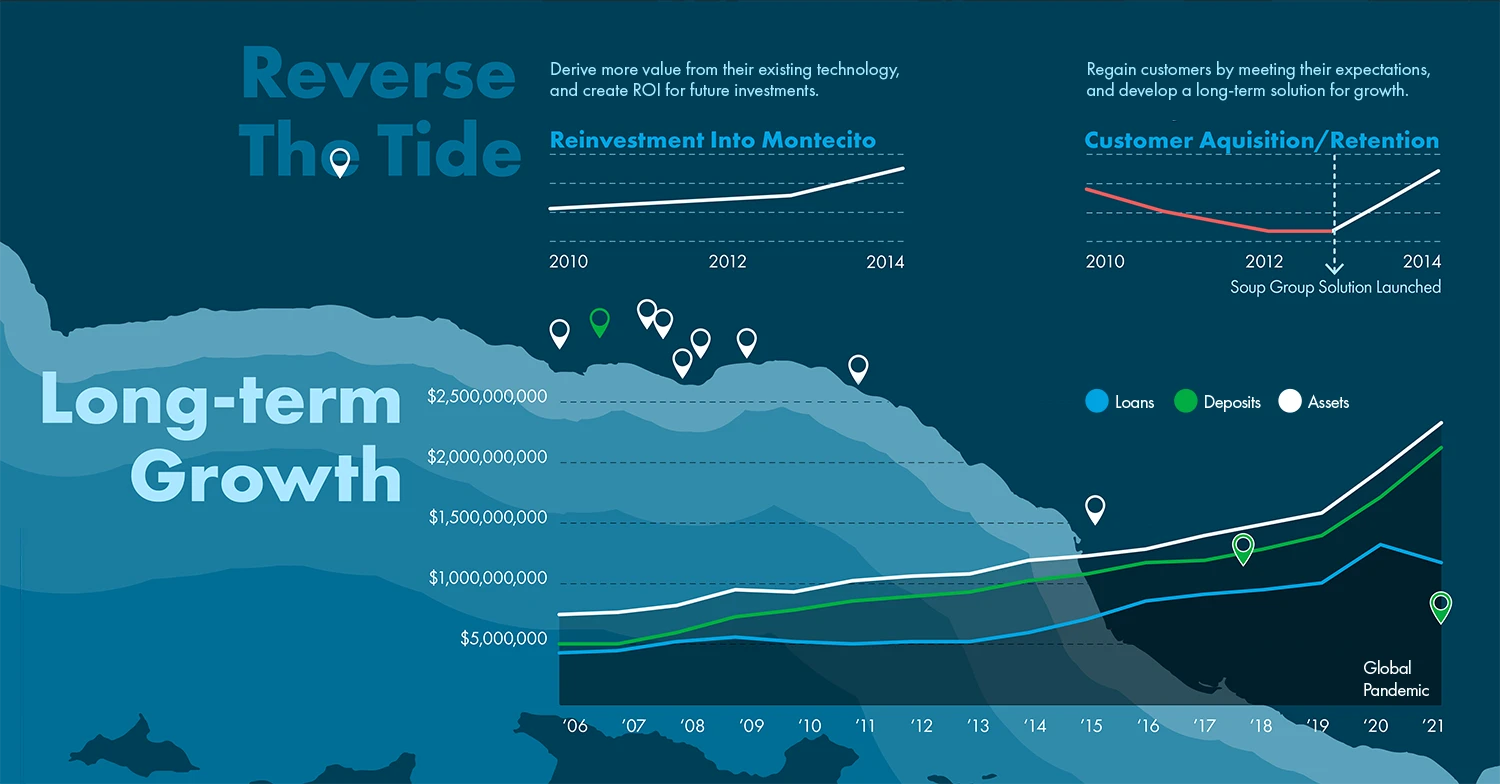

The Montecito Bank and Trust online banking systems were creating nightmares for their clients and customer service. The legacy core banking systems and applications that they relied upon couldn’t support customers’ rising expectations. Unexpectedly, their personal, commercial, credit card, and wealth management customers were leaving to find other, more modern banking solutions.

Most of Montecito’s customer service and retention issues were directly related to their online banking system. Most problematic were the inherent constraints in the aforementioned legacy banking systems. To make matters worse, the owners of these disparate systems were making it difficult and sometimes impossible to modify anything.

Montecito had never experienced customer attrition like this before. To call this an emergency would be an understatement. What was supposed to have been a customer service benefit that attracted and retained customers was now the exact opposite.

As a bank that prides itself on community and customer service, Montecito knew they needed to remedy these problems with a customer-centric modern online banking system.